Ontario Boat Insurance – What you Need to Know

Cliquez ici pour la version française.

Boating season is finally here, and before you get the boat in the water there are a few things you need to know about boating insurance.

I know, I know…most new boat owners are eager to talk about boat specs and the best fishing holes, but from time to time we have to get down to business and talk about things like insurance.

But don’t worry, we’ve already done all the hard work to fill you in on everything you need to know, this way you can save a little time on research and spend more time on planning your next trip out on the water!

So let’s get started…

Is Boat Insurance Mandatory?

Nope, getting insurance for your boat isn’t mandatory in Ontario.

That’s right, you heard it here first folks!

But wait! Before you take the risk to opt out of insuring your boat, there are a few things you should know!

You might still want to invest in boat insurance for peace of mind, but also because in many cases it actually is still a requirement.

For instance, if you plan to dock your boat at a marina, use a private boathouse, or you intend to finance your boat, you are likely going to need to prove that your boat is insured.

Most importantly, your boat is your pride and joy, and a great investment – yes, an investment! Like with all things we invest in, we want to protect them, because sometimes accidents and damages can happen to your boat both on and off the water!

Do I Need Stand-Alone Boat Insurance?

Most folks assume they can just slap their boat onto their home insurance policy. Well they aren’t necessarily wrong!

In fact, assuming your insurance company provides coverage for boats, (many do not), and your boat falls within certain length and horse power specifications, this can actually be a less expensive way of insuring your boat.

That said, a home insurance policy will not give you the same coverage as a stand alone boat policy, and you may be left regretting that choice when you need to submit a claim as they often provide limited coverage.

Not only does a stand-alone policy provide superior coverage designed for boats specifically, it’s also worth noting that claims submitted for your boat won’t impact your home insurance!

What Does my Insurance Cover?

Just like with insurance policies for your home or vehicle, insurance policies for boats can vary greatly based on the plan and the company you deal with.

Here’s a list of some of what you can expect an insurance policy to cover:

- Vermin coverage, because every boater knows someone who has experienced critter damage! As cute as chipmunks and squirrels might be, they tend to cause havoc on boats!

- Similarly to auto insurance, boat coverage should include coverage for bodily injury that your boat could inflicts on others, property damage the boat could inflict on other boats and docks, as well as any physical damages that could occur to your boat if you hit something.

- Don’t forget about Original Equipment Manufactured parts! While not all insurance companies offer this, some will take care of your claim using the original equipment manufactured parts.

- Coverage against theft, fire and flood, vandalism and even roadside (or waterside) assistance!

What Information do I Give to an Insurer?

Just like with your home or vehicle insurance, you will need to provide certain details to the insurance company about your boat and yourself so they can determine what coverage is best suited to you.

You should be prepared to provide the following information when shopping for insurance:

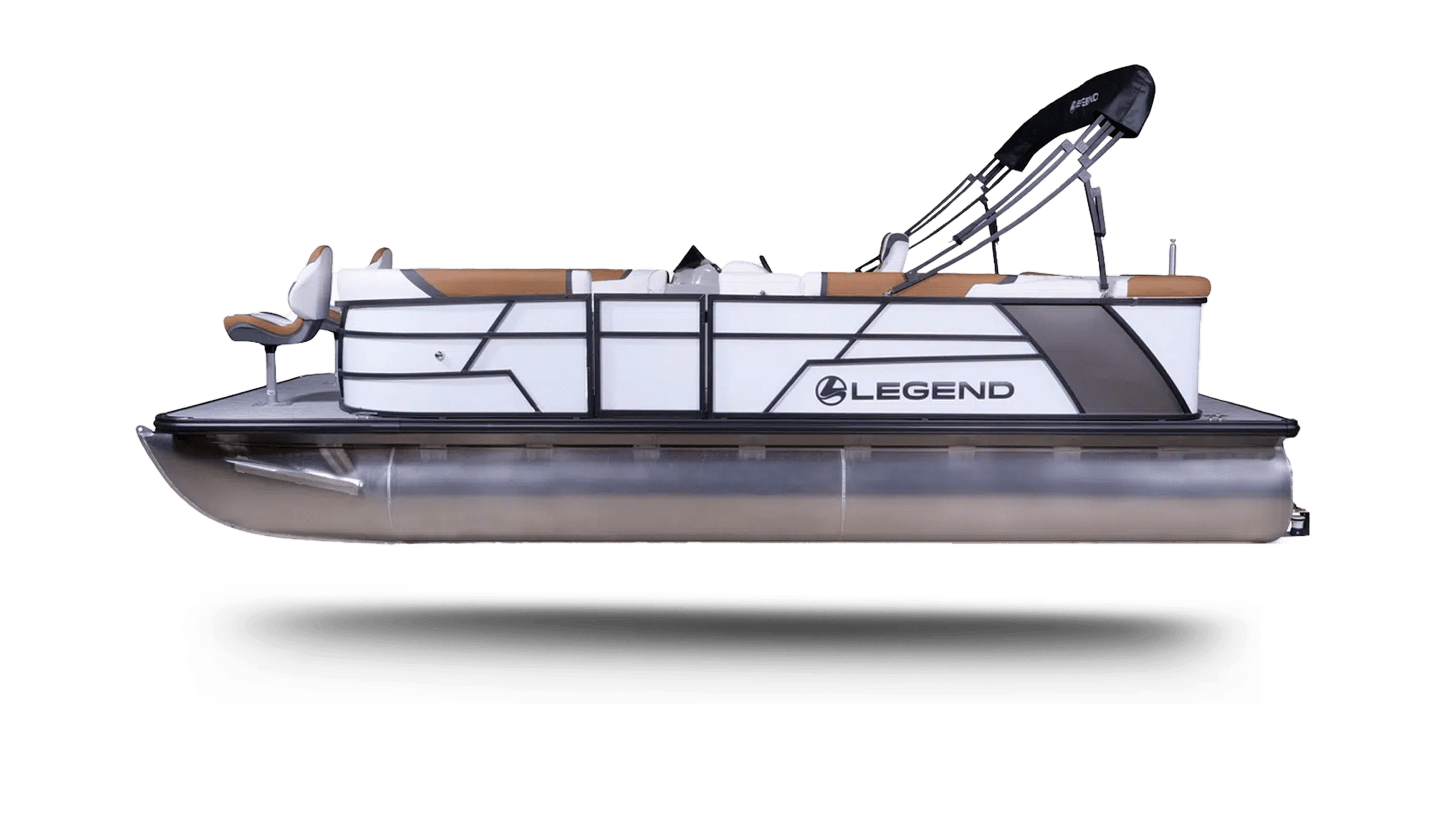

- Details about the boat, type of boat, length and value.

- How often you use the boat, and what the boat is used for.

- How the boat will be stored when it isn’t in the water.

- The location the boat will be used.

How Much Will my Insurance Cost?

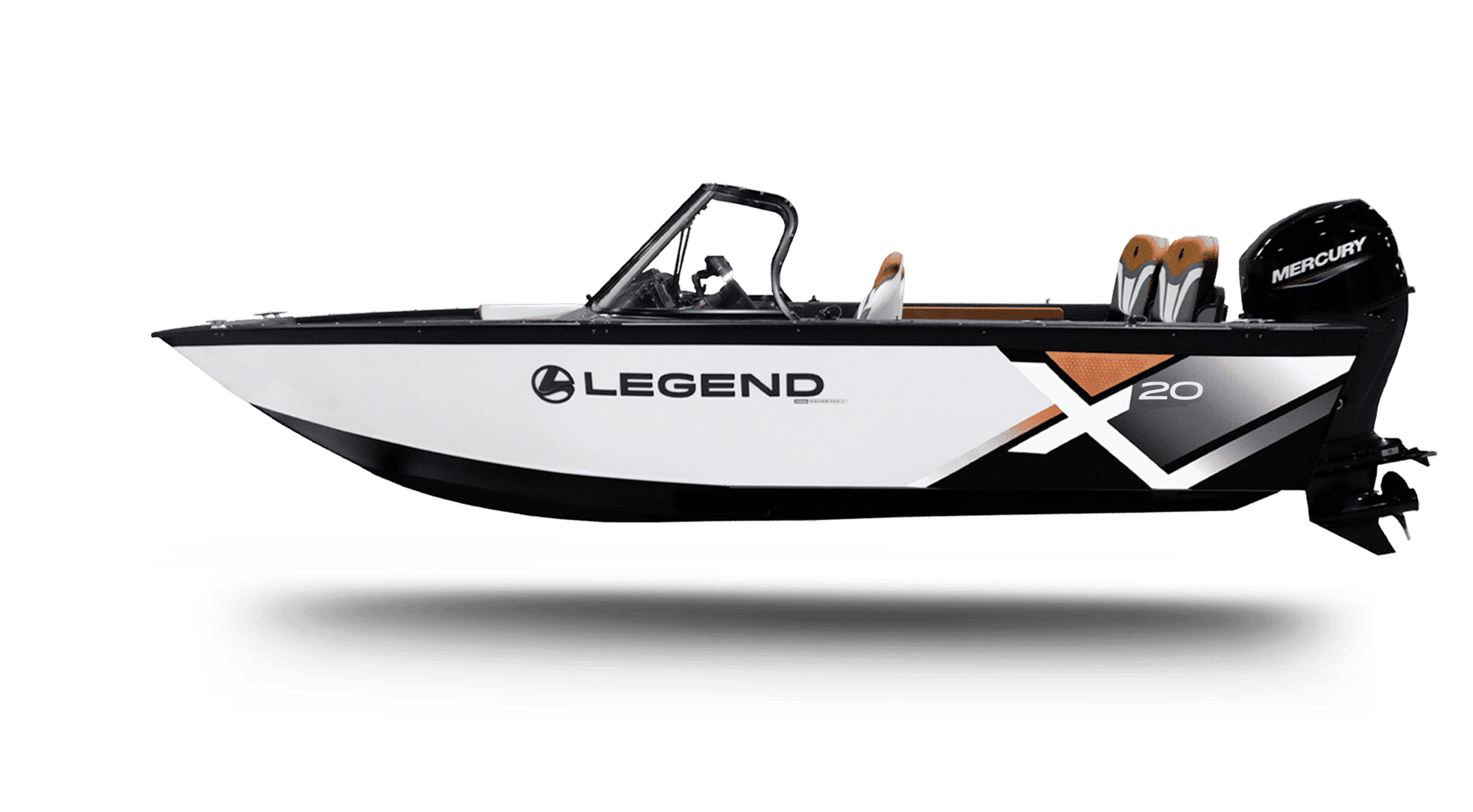

When it comes to boat insurance premiums, many factors need to be considered to narrow down a price point. First off, are you adding your boat onto your home insurance policy or getting stand-alone boat insurance? Other factors that help determine the cost of your insurance include the value of your boat, the horse power, the top speed, the length of your boat, the location it will be stored, the use of the boat, and how often it will be used.

Similarly to vehicle or home insurance, the cost really is dependent on a number of factors and the type of coverage you are looking for!

Here at Legend Boats we specialize in all things boats, including insurance. For more information on available insurance packages, and pricing you can contact your local Legend Boats Dealer! Click here to access our dealer locator.

See, that wasn’t so hard! And now you have the peace of mind knowing that you are covered while you are out on the lake enjoying the ride.

Where Can I Insure My Boat?

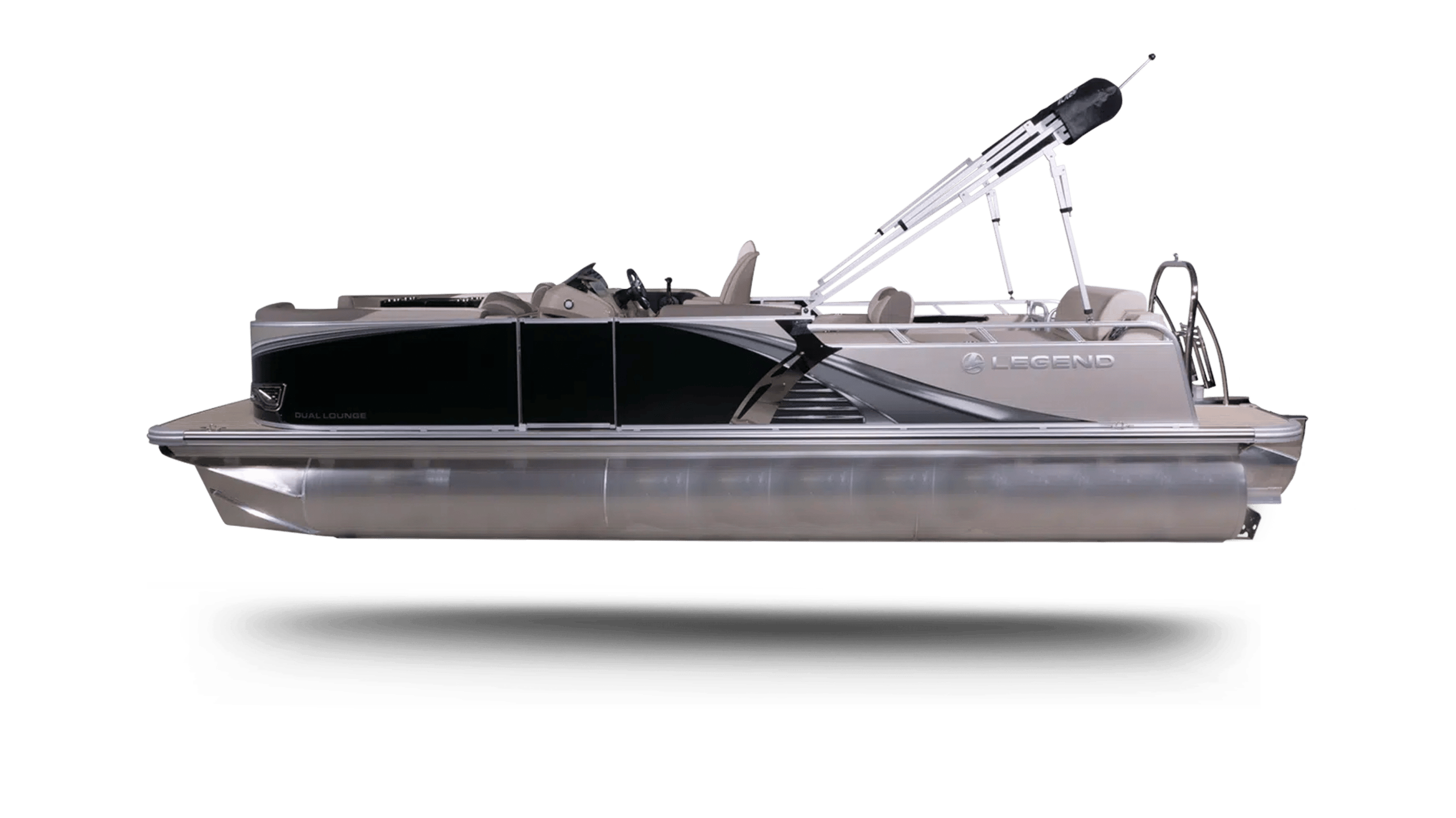

We’re thrilled to introduce Legend Insurance! Making it easier than ever to insure your boat, if you choose.

We all know that stuff happens, but when that stuff messes with our weekend plans, we take it seriously. At Legend Insurance, we love being out on the water, just like you! That’s why we offer insurance coverage that, if an accident occurs, makes sure you can still enjoy the maximum amount of time on the water.

To learn more about Legend Insurance, click here.

Happy Boating!