Boat Insurance – The Questions to Ask

For many, boat insurance is foreign territory and the tendency is to call your home and auto broker or agent because there is already a relationship there. Before making the decision to add your boat to your home insurance, it is well worth

the time to explore all of the options and coverages that are available. Homeowners’ policies are not designed for boats and may not cover or may limit the unique exposures you may encounter as a boater. A specialized boat insurance policy provides a suite of coverages designed specifically to protect you and your boat.

To explore how a specialized boat insurance policy works, let’s use an example. You are boating on a lake and the unthinkable happens. You hit a rock and call for help. Safely on land you learn the boat has sunk.

What happens now? How does your boat insurance policy respond? First, you are responsible for the removal of the boat and for the cleanup of the spilled oil and gas resulting from the collision. Your policy responds by paying for the boat removal and environmental cleanup. While the boat is laid up at the marina you have family arriving at the cottage for a family reunion. Your policy’s Loss of Use coverage responds by providing you with coverage to rent a boat. Your boat is deemed a total constructive loss. You have insured the boat for $45,000. Your policy responds by giving you $45,000 to buy a new boat, without depreciation because your policy is an Agreed Value Policy, meaning there is no depreciation on physical damage losses until the boat is 15 years old.

This example highlights five important coverages that are included in a specialized marine insurance policy: Agreed Value Coverage (no depreciation), Loss of Use (rental boat), Wreck Removal, Collision (hitting a rock), and Accidental Pollution Liability (environmental cleanup). These are coverages designed to protect you as a boater. Before making the decision to add your boat to your home insurance remember to ask if these coverages are included.

Let’s look at another example to explore how the Liability coverage works on a specialized boat insurance policy. You are spending the day tubing with your family. Using the same example of hitting a rock, the sudden jolt knocks your son and his friend from the tube and they are injured. The boat is immobilized and you call a local marina for a tow. Your policy responds by paying the emergency towing costs and the repair of the boat – no after-market or re-built parts are used. The medical coverage on your policy is available to respond to your son’s injuries. The parents of your son’s friend sue you for his injuries. Your policy responds through the liability coverage.

This example highlights three other important coverages included in a specialized boat insurance policy: Watersports liability, Emergency Medical/Accidental Death Payments and No depreciation on a partial loss (no after-market or re-built parts). Make sure your homeowner’s policy includes these.

There are a few other coverages that should be mentioned because, like the above, they too are designed specifically for boaters. A specialized marine insurance policy will include Uninsured Boater Coverage. Boat insurance is not mandatory in Ontario which is exactly why you should have it. There are a lot of boaters who do not carry insurance, putting you at risk if you are injured or your boat is damaged by them. Your own policy will respond through its Uninsured Boater Coverage. Personal Effects Coverage is included on a boat policy, covering loss to your personal items like clothing, cell phones etc. Animal damage can be an issue during the winter months when racoons move in. Coverage for animal damage is included. Trailering your boat presents its own set of risks. Coverage for trailering is included. These are coverages you will want to ask your home insurer about before making your decision.

The final point we would like to make is about separation of risk. Before you place your boat with your home policy, be sure to ask what happens to your rate if you have a claim on your boat. To use an example, if your boat is stolen, home insurance companies will increase your home insurance rate because of the boat claim. You now have a claim on your home insurance policy. Conversely, if your boat is kept separate from your home policy, the same theft does not affect your home policy but, rather, is exclusive to the boat policy.

There is no standard marine insurance policy so it falls on you, the policy holder, to understand what you will need and what each policy will cover. This can be very overwhelming. You invested a lot of time in choosing the right boat and its extremely important to make the choice of insurance equally as important. When you choose to insure with a provider who specializes in boats not only will you get an insurance package designed specifically for boaters, but you will also be dealing with those who know and understanding boating. You get their knowledge and expertise and an ease of doing business with someone who will make boat insurance easy without sacrificing coverage.

Where can you insure your boat?

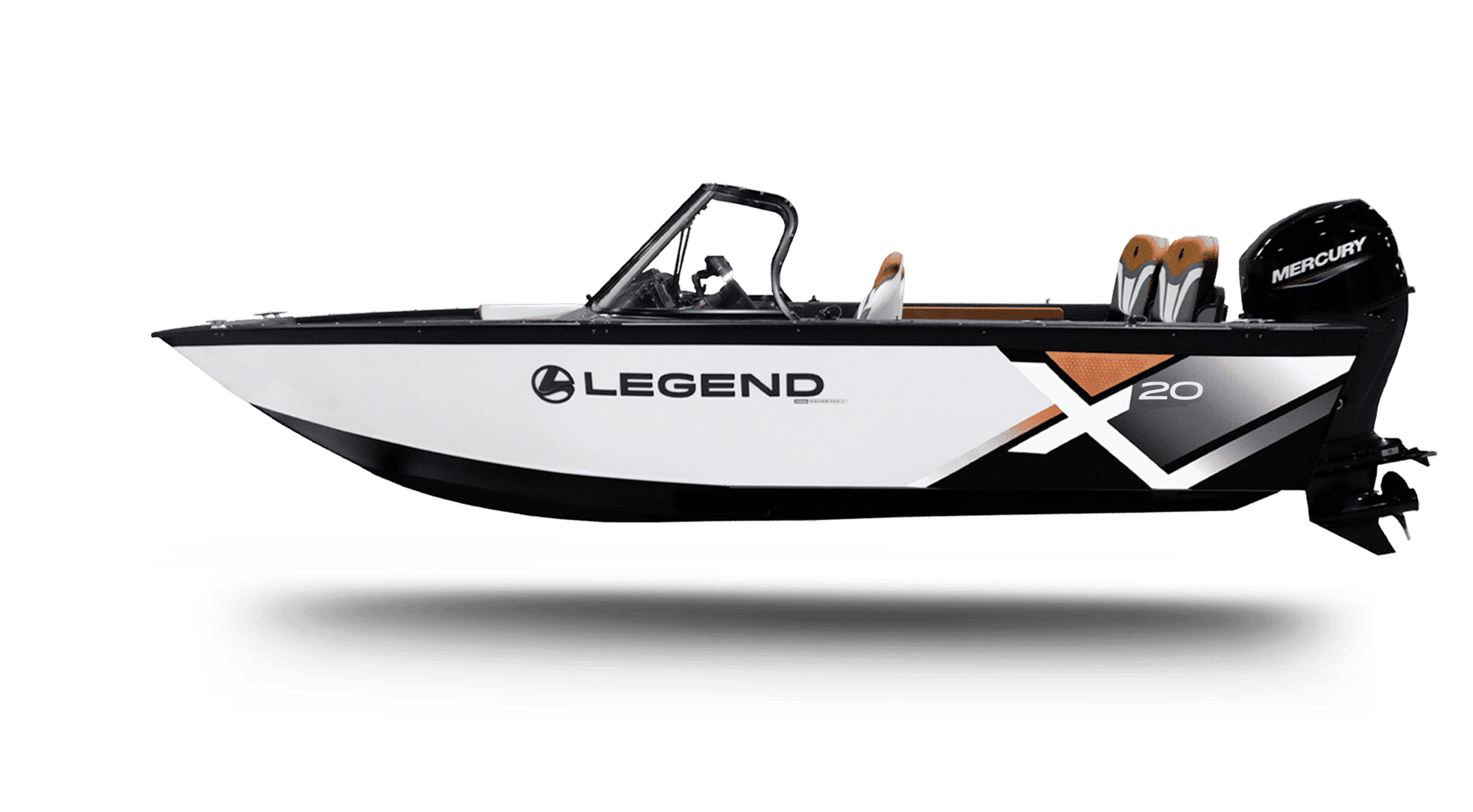

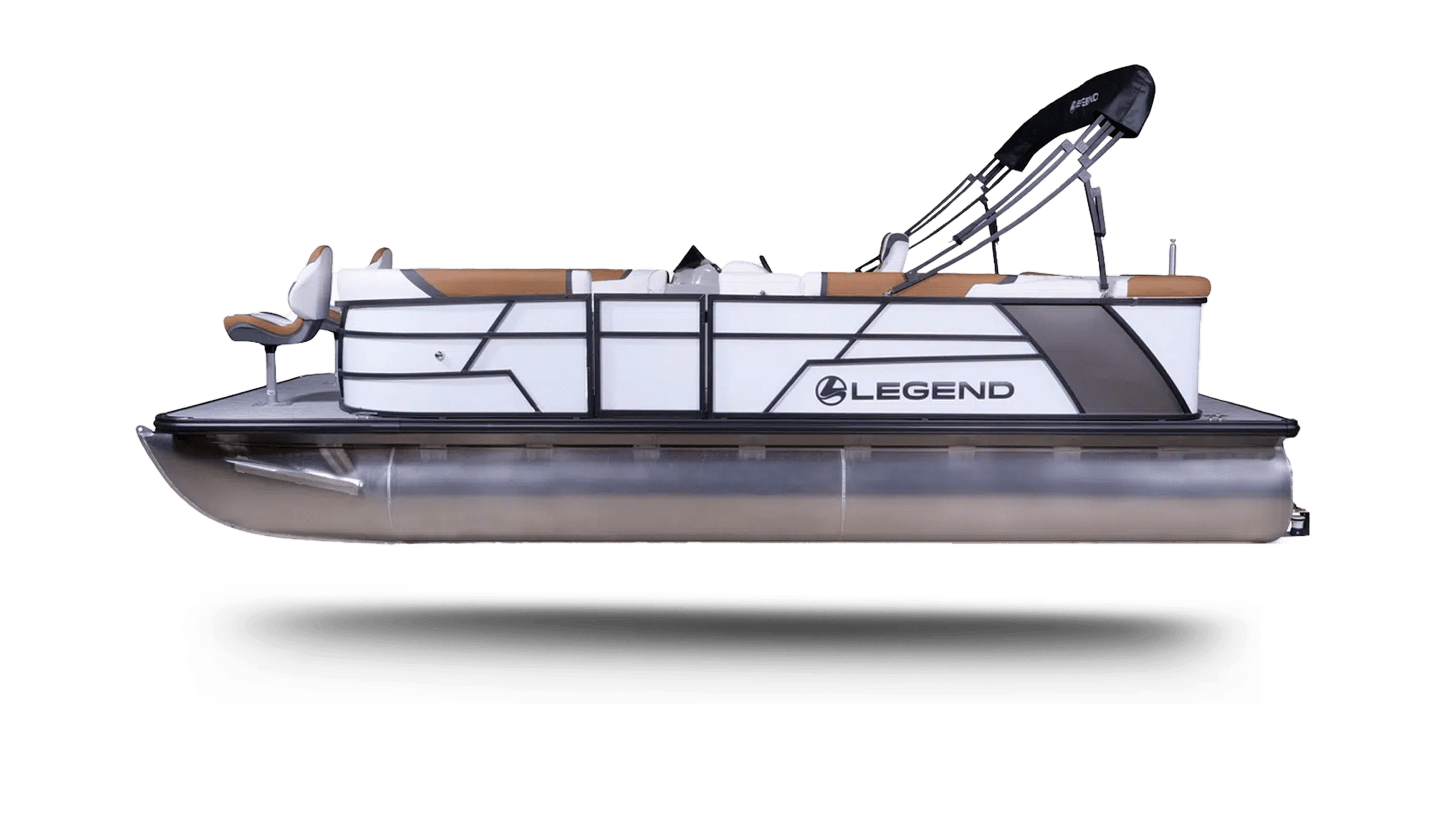

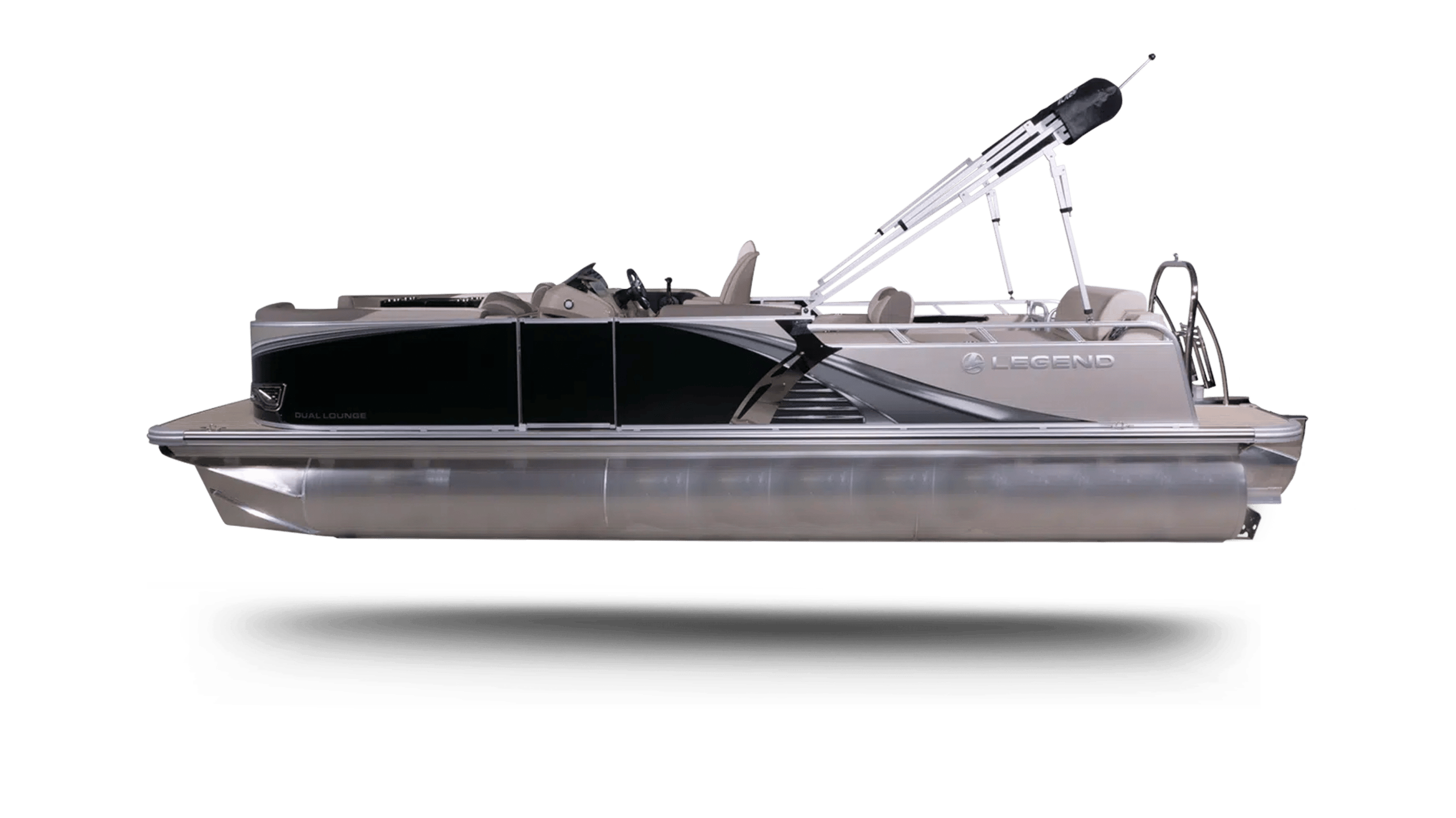

Introducing Legend Insurance!

We all know that stuff happens, but when that stuff messes with our weekend plans, we take it seriously. At Legend Insurance, we love being out on the water, just like you! That’s why we offer insurance coverage that, if an accident occurs, makes sure you can still enjoy the maximum amount of time on the water.

To learn more about Legend Insurance, click here.

Happy Boating!

If you like this, you might also like the Boat Buying Guide article.